how are property taxes calculated in martin county florida

Current tax represents the amount the. The median property tax on a 25490000 house is 231959 in Martin County.

St Lucie County Fl Property Tax Search And Records Propertyshark

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

. Your action has restored my confidence in a national system plagued by delay. The Martin County assessors office can help you with many of your property tax related issues including. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the original homestead was abandoned.

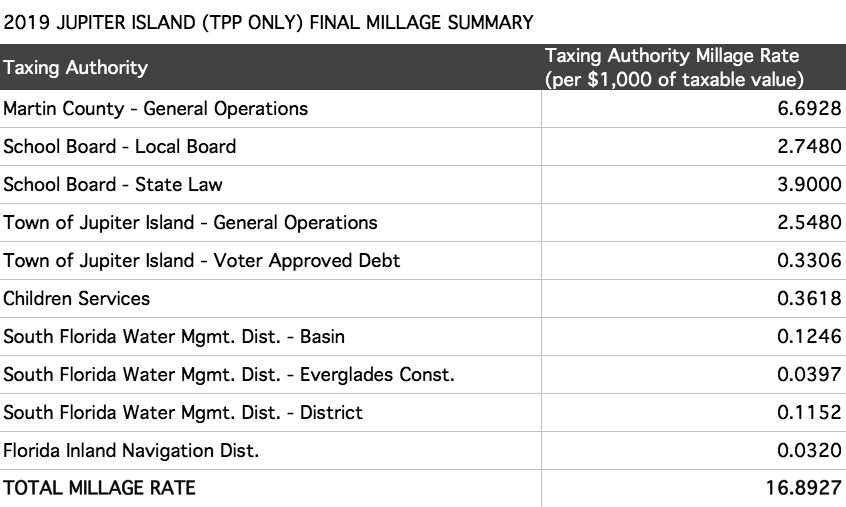

The latter is usually the wildcard. The millage is 7 mills for county schools and 11 mills for all non-school taxing authorities combined city county and special districts. Find the assessed value of the property being taxed.

The Martin County Tax Collector office will be closed on Monday May 30 in observance of Memorial Day. Find Records For Any City In Any State By Visiting Our Official Website Today. Martin County is committed to ensuring website accessibility for people with disabilities.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Please call the assessors office in Stuart before you send documents or if you need to schedule a meeting. One mill equals 100 per 100000 of property value.

Were here to help you. Florida Property Tax Rates. The Martin County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Martin County and may establish the amount of tax due on that property based on the fair market value appraisal.

The tax year runs from January 1st to December 31st. Florida is ranked number twenty three out of the fifty states in. View 2021 Millage Rates.

The median property tax on a 18240000 house is 176928 in Florida. Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. For information on Non-Ad Valorem taxes please call the Martin County Tax Collectors office at 772-288-5600.

Florida is ranked number twenty three out of the fifty states in order of the average amount. Apache Server at pamartinflus Port 443. Its a little different in GA but similar in that the millage rates varied widely from county to county.

This estimator is based on median property tax values in all of Floridas counties which can vary widely. Please note that we can only estimate your property tax based on median property taxes in your area. The median property tax on a 14350000 house is 139195 in Florida.

Property values are usually determined by a local or county assessor. Martin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. I want this shown to your Superior to let him or her know how pleased I am to see such professional courteous and immediate attention that I really did not expect.

These are deducted from the assessed value to give the propertys taxable value. When it comes to real estate property taxes are almost always based on the value of the land. 097 of home value.

For a more specific estimate find the calculator for your county. Trash drainage taxes or special assessments. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates.

To calculate the property tax use the following steps. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. First we explain a bit about property taxes in general and then delve into Floridas property tax system.

The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of 091 of property value. Tax amount varies by county. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Your property tax is determined by the taxable value multiplied by the county millage rate. The more valuable the land the higher the property taxes. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

The estimated tax range reflects an estimate of taxes based on the information provided by the input values. One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. It is understood that estimated Non-Ad Valorem taxes must be added to the estimated Ad Valorem taxes to obtain the full estimated property taxes of the proposed property ie.

When it comes to real estate property taxes are almost always based on the value of the land. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the County ADA Coordinator 772 320-3131 Florida Relay 711 or. In fact the earliest known record of property taxes dates back to the 6th century BC.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The median property tax on a 25490000 house is 247253 in Florida. There are some protections in place to prevent the abuse of assessed values.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Floridas property taxes are considered quite high yet they fall below the average for the USA at 094. Ad Searching Up-To-Date Property Records By County Just Got Easier.

The maximum portability benefit that can be transferred is 500000. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. This simple equation illustrates how to calculate your property taxes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Having trouble finding what youre looking for in our website. The millage rate for Boca Raton is 18307 per 1000 of value so you are paying.

Property taxes are one of the oldest forms of taxation. You can call the Martin County Tax Assessors Office for assistance at 772-288-5608. New York Property Tax.

If you have general questions you can call the Martin County. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. The median property tax on a 18240000 house is 191520 in the United States.

The median property tax on a 25490000 house is 267645 in the United States. Tax amount varies by county. If you purchase a home in Florida property tax is levied and paid at the county level and is based on the u201cjustu201d or fair market value of the property.

Are The Taxes Lower In Martin County Than Palm Beach County 2019 R R Realty Jupiter Real Estate

Property Taxes Ad Valorem Polk County Tax Collector

Property Tax By County Property Tax Calculator Rethority

Treasure Coast Property Values Still Climbing That Might Not Be Great News Our View

Palm Beach County Fl Property Tax Search And Records Propertyshark

260 Se Villas St Stuart Fl 34994 Realtor Com

Martin County Property Appraiser Homestead Tax Estimator

Florida Property Tax H R Block

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Keeping Them Flying Martin County Sheriff S Office Vertical Mag

How Much Florida Homeowners Pay In Property Taxes Each Year Fernandina Observer

Florida Vehicle Sales Tax Fees Calculator

2022 Best Places To Buy A House In Martin County Fl Niche

467 Sw Lost River Rd Stuart Fl 34997 Realtor Com

Indiana Property Tax Calculator Smartasset

Property Tax By County Property Tax Calculator Rethority